Startup post mortem: Neta.

The unfiltered story about founding, scaling & closing a VC-backed startup, with all the lessons learned.

15 months after launching & raising >$10M, Neta is shutting down and returning the money. I’m going to try to keep it short and simple as I believe 90% of business books could’ve been a blog post.

TLDR;

Context on Neta

What was Neta? E-commerce for the base of the pyramid.

How did Neta try to do it differently:

(i) by tapping SMBs (the “neighborhood store”)

(ii) leveraging gamification to make online shopping social & fun

What’s the one-pager story?

Launching: It’s all about painting the door

Scaling: From $0 to $8M GMV in 9 months

Shutting down because of No Profitable PMF

What were the lessons learned?

+ 10 tactical lessons

Open Questions

What’s next for Nico?

What’s the one-pager story?

Gabriel García Márquez once said, “ninguna aventura de la imaginación tiene más valor literario que el más insignificante episodio de la vida cotidiana.” (in Spanish because the translated version doesn’t sound as sexy)

Launching: It’s all about painting the door

May, 2021: Before launching, Neta had:

Money: pre-seed round of $550k from investors such as Jeff Weiner, Julio Vasconcelos, Picus Capital. (Kudos Pablo!)

Team: 3 co-founders (Pablo - CEO, Diana - Product, Nico - Growth) & employee #1 (Andres - Ops).

Vision: “E-commerce for the 95% of LatAm who have never shopped online, but own a smartphone”.

June, 2021: Neta’s first dollar of revenue was fast, it was acquired by Nico & fulfilled by Andres. The day after Nico arrived in Mexico, he went hunting (walking streets) to acquire SMBs for Neta, and fortunately Fabián from Abarrotes León said yes. The problem was Neta had no product, so Nico went home and set up an MVP so Fabián could share neta.mx to clients. Andres then fulfilled those orders by buying at Walmart and delivering them in Uber, but for Fabián & his clients it was a magical experience. Neta painted the door (launched as fast as possible), which comes from Chipotle, who painted stores on the outside before officially opening to see how many people would stand in line. The picture is with Fabián, client #1.

July, 2021: Neta then went on to “gamify” the MVP with group-buying on typeform (kudos Diana!), which kicked-off exponential growth and a $4.9M seed from investors such as Kaszek & Founders Fund.

Scaling: From $0 to $8M GMV in 9 months

August, 2021 - June, 2022: The seed round + signs of PMF (long-term user retention flattening) resulted in exponential growth: from $0 to $8M GMV in 9 months…

…but with suboptimal (bad) Unit Economics.

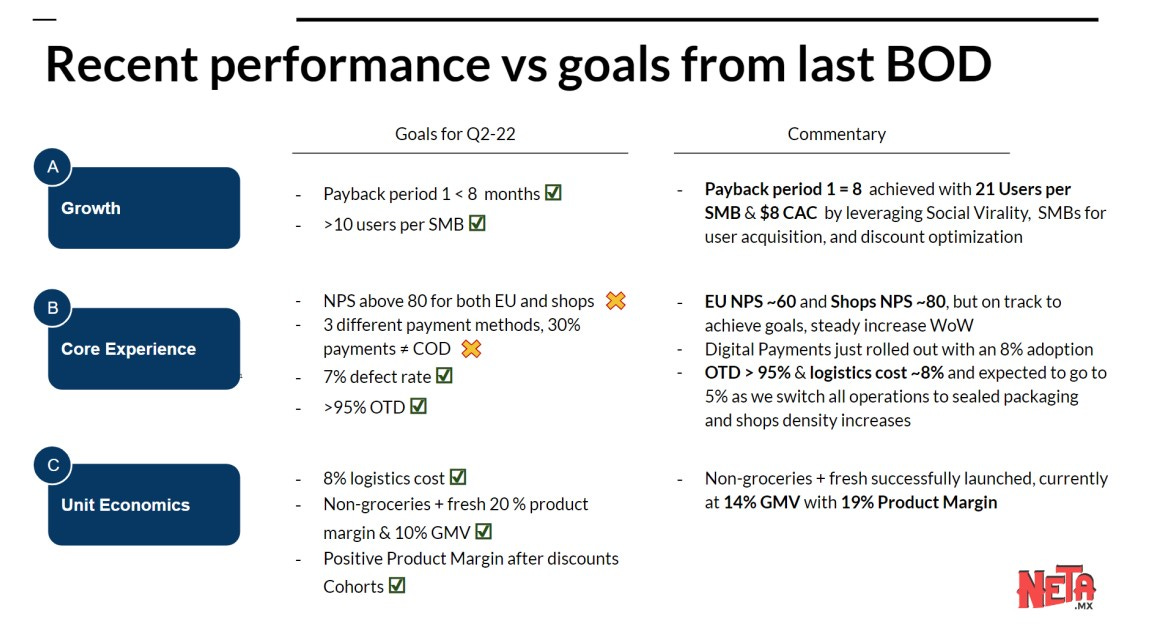

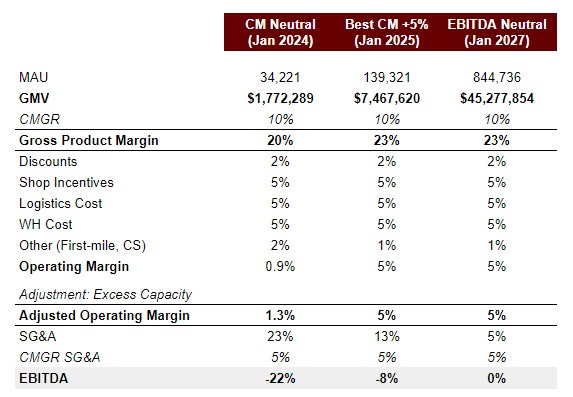

July, 2022: Fast-forward to the Board meeting for Q2-2022, we met 7/9 objectives, but the road to EBITDA neutral was too far away & required bull-market conditions (and the current market looks more like a bear). Neta had some good metrics vs. peers (CAC, Users per SMB, Logistics Cost), but Product Margin was our Achilles heel. The base of the pyramid only cares about price.

Shutting down because of No Profitable PMF

(i) The social commerce dream has some similarities with ride-sharing: years & money burned in order to deliver a profit, but ride-sharing had the benefit of the longest bull market. There is only one successful social commerce in the world: PinDuoDuo (PDD).

(ii) The base of the pyramid only cares about price, they don’t care about convenience. Tough realization. In my honest opinion, it will be a race to the bottom in price.

For example, if MELI/Amazon is cheaper, why would people buy from Neta and not from MELI or Amazon’s pick-up point?

Social component/trust? I think that works as an acquisition strategy, not as a retention one. Social commerce does the heavy lifting of acquiring the user, and once the person trusts online platforms goes price hunting to see which one is cheaper.

Payment methods? I think that’s a time moat, eventually this population will have digital payments and/or existing platforms will accept cash on delivery.

No delivery fee? Dangerous time moat, as MELI/Amazon already do it in some cases and it’s not sustainable in unit economics.

The social commerce model inserts an extra middle-man (community leader in some cases, SMBs in Neta’s case) in a low margin supply chain. The only way to win is to provide products without as many middle man.

Maybe LatAm leapfrogs to B2C e-commerce without passing through B2B2C e-commerce.

We were offered bridges from investors to continue down the social commerce dream (“the infamous bridge to nowhere”), but the reality was there was no profitable PMF. Neta looked more like an ONG (to be totally blunt). Neta had a capital intensive business model unfavored in the current economy. We considered a pivot, but people take months/years finding an idea, and finding and marrying an idea in a couple of weeks seemed suboptimal.

We decided to shut down and return the money that was left. There is and will be some form of frustration in me about it, but I will always feel gratitude towards every individual that wore the Neta shirt: employees, clients, investors, partners.

A message from a “Netuano” after announcing the wind-down:

What were the lessons learned? Post mortem

The Power of PMF: Priority #1 is to find PMF, and ideally Profitable PMF.

Julio Vasconcelos said it in a podcast: “PMF solves all problems; and without PMF it doesn’t matter how great the team is.”

Don’t scale too fast.

Don’t scale bad unit economics. First PMF, and ideally Profitable PMF (with Contribution Margin >0%), and then scale. Top-line without unit economics is a vanity metric.

Don’t scale team too fast: Neta went from $0 to $8M GMV & from 4 to 80 people in 9 months. Headcount should NOT be bragged about. “Hire 1 person, and that 1 person does the job of 2 people; hire 2 people, and those 2 people do the job of 1 person.”

Before PMF, hire generalists. Post PMF, hire specialists.

Strategy = focus. Solve ONE problem better than anyone else.

Don’t chase shiny objects.

This is hard in LatAm (or in developing economies), where certain business models require a lot of heavy-lifting because you can’t piggyback. “We are building the hardest company in LatAm” said Samuel Giraldo (Head of Ops) several times. He was right, we were building 3 massive companies in one:

A strong front with a product-led-growth/social virality e-commerce.

A state of the art backend/supply chain: Procurement, Warehouse, Logistics, Payments, Customer Service.

A pick-up sites (SMBs) network.

Obsess about problems, not solutions.

X for LatAm is an overrated mindset, it leads to building solutions instead of solving problems.

Think, research and test the problem deeply:

Who suffers the problem?

How acute or severe is the problem?

How big is the problem?

Can I solve it in a profitable way?

When benchmarking startups, understand the problem they solve, not just the solution they’ve built.

E.g. Neta, and many more, wanted and want to build “PDD for LatAm”

Don’t take for granted a startup’s success, regardless of valuation or headlines. Dig deeper.

When researching incumbents, understand their P&L and why you can solve the problem more efficiently.

Many Product Managers/Leaders in LatAm are feature builders, not problem solvers.

Market beats team

Warren Buffet: “When a management with a reputation for brilliance tackles a business with a reputation for bad economics, it is the reputation of the business that remains intact.”

10 tactical learnings

Correct decisions > popular decisions. Don’t try to please stakeholders with your decision making, do what’s best for the company.

Don’t listen to all advice. Take some with a grain of salt.

How co-founders behave and what they do will determine the early culture.

Be intentional about culture and hire someone to lead People sooner than later.

Culture rituals that worked: (i) Every meeting with a pre-read & agenda, read it offline & comment during first minutes; (ii) Monthly plans with qualitative initiatives & quantitative results (KPI’s); (iii) Weekly Business Review (WBR) first thing Monday morning; (iv) Constant mutual feedback sessions with direct reports. Mines were weekly 15 minutes every Friday.

Don’t look at VC funding as an end-goal. Bootstrapped companies are great.

99% of tech people in LatAm don’t understand business and viceversa. The gap is gargantuan and needs to change.

99% of Product Managers/Leaders in LatAm are not great. They are feature builders, not problem solvers.

Ruthless meritocracy: best athletes in the front-line.

Hire slow, fire fast. Never compromise on talent and ethics.

A players bring A players, B players bring C players.

Leadership is not friendship.

“It’s better to make friends in business than to do business with friends.”

Never hire someone you can’t fire.

In many hard things (e.g. layoffs), the anticipation is worse than the actual moment. It’s like taking a cold shower, before you go in is more scary than the actual cold bath.

Quantitative (data) AND qualitative (talk to users) always in decision making. AND not OR.

Strong opinions, weakly held.

Overcommunicate until everyone gets it. Especially vision.

Open Questions

How is PMF defined? The majority of definitions are flawed in my opinion as they ignore Unit Economics.

"Flat long-term user & revenue retention”

“Growing 20% month over month, with at least 80% of acquisition being organic”.

What is the role of the CEO at a startup? The definitions I’ve heard:

“MVP: Money, Vision, People”

“Strategy & Capital Allocation”

“Pre-PMF is to find PMF, anything else is a distraction.”

What are the top characteristics to look for in a co-founder?

In my opinion, it’s a >10 year marriage & you have to (i) share work-ethic & values, (ii) have blind trust in each other, (iii) admire one another, (iv) feel no shame (a lot of pushback expected) & be radically transparent, (v) have a complimentary skill-set.

I would extrapolate characteristics to building your exec team.

Why did I write this?

I hope more people become “2nd time founders” by reading it. Founding & failing can have upside. Paul Graham says it better in his essay “Why To Not Not Start a Startup” (link).

Public recognition to a rockstar team.

Any and all feedback welcome.

What’s next for Nico?

2nd time founder. Probably in the health-tech space.

Humbled and grateful after this hell of a ride.

-Nico

Leaving ecommerce for health tech, you must be a sucker for punishment :) I kid!

Well done on the effort and for writing about it. All the best in your future endeavours.

On your point on PMF, I had heard a VC talk about this. They said there are 3 kinds of PMF and in your journey you need to progress from one to the next. 1. PMF, 2. Profitable PMF, 3. Profitable Scalable PMF. And you are absolutely right regarding obsession with just PMF, ignoring unit economics. Some of this due to a lot of literature / talk based on software companies where your customer acquisition cost is almost 0 (think social media). But companies that involve physical supply chains and multiple value adding players, unit economics is super important.

Wishing godspeed on your next chapter